One Homebuying Step You Don’t Want To Skip: Pre-Approval

There’s one essential step in the homebuying process you may not know a whole lot about and that’s pre-approval. Here’s a rundown of what it is and why it’s so important right now.

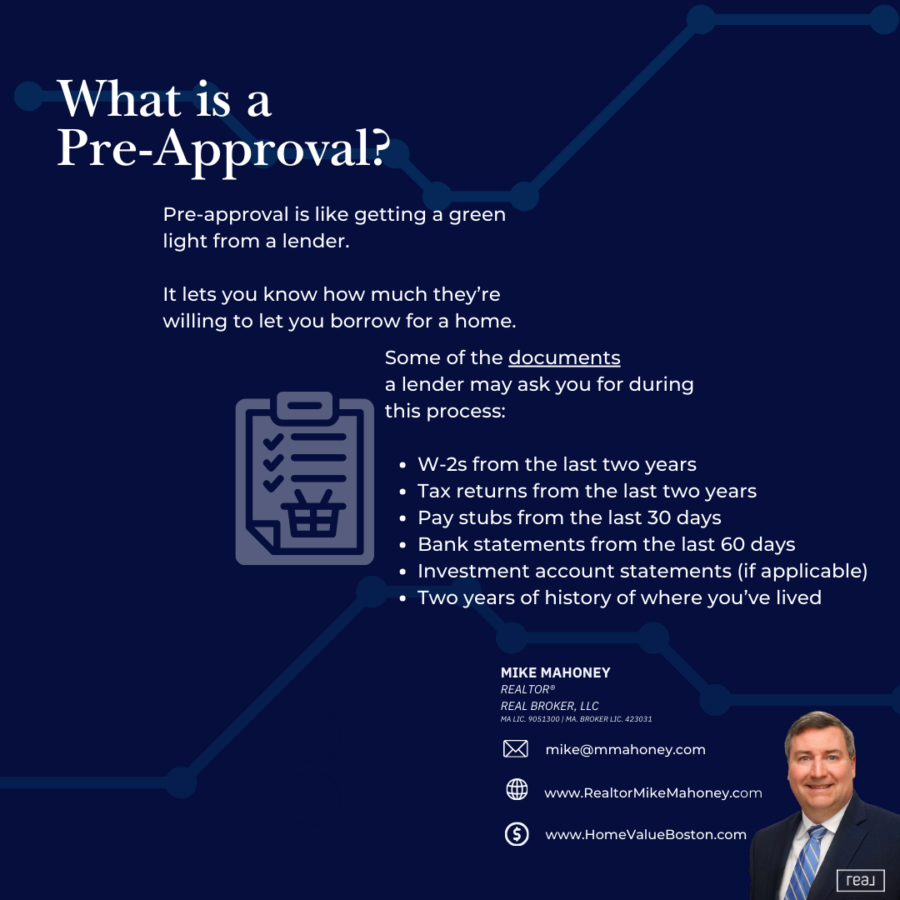

What Is Pre-Approval?

Pre-approval is like getting a green light from a lender. It lets you know how much they’re willing to let you borrow for a home. To determine that number, a lender looks at your financial history. According to Realtor.com, these are some of the documents a lender may ask you for during this process:

- W-2s from the last two years

- Tax returns from the last two years

- Pay stubs from the last 30 days

- Bank statements from the last 60 days

- Investment account statements (if applicable)

- Two years of history of where you’ve lived

The result? You’ll get a pre-approval letter showing what you can borrow. Keep in mind, that any changes in your finances can affect your pre-approval status. So, after you receive your letter, avoid switching jobs, applying for new credit cards or other loans, or taking out large sums of money from your savings.

How It Helps You Determine Your Borrowing Power

This year, home prices are expected to rise in most places and mortgage rates are still showing some volatility. So, since affordability is still tight, it’s a good idea to talk to a lender about your home loan options and how today’s changing mortgage rates will impact your future monthly payment.

The pre-approval process is the perfect time for that. Because it determines the maximum amount you can borrow, pre-approval also helps you figure out your budget. You should use this information to tailor your home search to what you’re actually comfortable with as far as a monthly mortgage payment. That way, you don’t fall in love with a house that’s out of your comfort zone.

How It Helps You Stand Out

Once you find a home you want to put an offer on, pre-approval has another big perk. It not only makes your offer stronger, it shows sellers you’ve already undergone a credit and financial check.

When a seller sees you as a serious buyer, they may be more attracted to your offer because it seems more likely to go through. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“Preapproval carries more weight because it means lenders have actually done more than a cursory review of your credit and your finances, but have instead reviewed your pay stubs, tax returns and bank statements. A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.”

Bottom Line

If you’re planning on buying a home, getting pre-approved for a mortgage should be one of the first things on your to-do list. Not only will it give you a better understanding of your borrowing power, it can put you in the best position possible to make a strong offer when you find a home you love. Connect with a trusted lender to learn more.

f you want help weighing your options and thinking through how the current market factors in, let’s connect.

Michael Mahoney

617-615-9435

mike@mmahoney.com

MA. License #9051300

Real Broker LLC License #423031

☎️ 📆 Schedule a Call with Mike Now

Linkedin Profile | Resume | Brochure | Client Testimonials | Facebook Page Twitter Youtube Instagram

See all the Properties in Greater Boston @ www.HomesinBostonMass.com

I am Michael Mahoney, a full time Realtor in Greater Boston focused on Norfolk & Suffolk Counties. I have been helping people fulfill the “American Dream” through home ownership, real estate wealth building, and real estate investment for over 2 decades.

I am Michael Mahoney, a full time Realtor in Greater Boston focused on Norfolk & Suffolk Counties. I have been helping people fulfill the “American Dream” through home ownership, real estate wealth building, and real estate investment for over 2 decades.

My goal is to help people “go from the life they have to the life they dream about” using real estate as means to build wealth and financial security. If you want to make a change, I help people go from the “what if” to the “what is”.

I work in all price points. The majority of my business is repeat clients and the referral of clients from all over Eastern Massachusetts.

I view my role as the advisor who helps people go from the life they have to the life they dream about. I help people go from the “what if” to the “what is”

I have sold everything from mobile homes to amazing estates. I have sold hundreds of homes, multi families and condos in almost every town in Suffolk and Norfolk County. I also sell homes in Plymouth, Bristol and Middlesex Counties. When asked what my specialty is, I often joke and say “from section eights to great estates”.

There is no property too small or too large in the residential space that I would shy away from.

All of my personal sales and marketing endeavors are supported by top-of-the-line personal market research completed carefully with expertise in order to create strategically targeted marketing collateral and campaigns for clients. I personally have a stand by commitment of 7-days a week for my clients. I aim to cultivate my own reputation for quality, professionalism and your results.

From selling hundreds of homes in Greater Boston comes experience and situational awareness that can only be developed over time which is a tremendous value to clients.

Some of my service areas include:

Service of My Service Areas Include:

Ashland Attleboro Avon Bellingham Boston Braintree Brockton Canton

Dedham Dorchester Dover Foxboro Framingham Franklin Holbrook

Holliston Hopedale Hyde Park Mattapan Medfield Medway

Milford Millis Milton Natick Norfolk North Attleboro Norwood Plainville

Quincy Randolph Roslindale Sharon Sherborn Stoughton Walpole Wellesley

West Roxbury Westwood Weymouth Wrentham